How Long Does a Mortgage Pre Approval Last?

For first time home buyers, there are numerous steps to take in the home buying process. One of the most critical steps is getting a mortgage pre-approval. But what is that exactly and how long does a mortgage pre-approval last?

Here’s everything you need to know if you’ve received a mortgage loan pre-approval letter in the mail.

What is a Mortgage Pre-Approval?

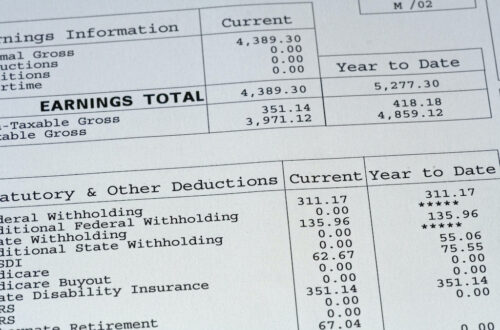

If you’ve been successfully granted a mortgage pre-approval, congrats! This is one of the most important steps you can take in purchasing your first home. A mortgage pre-approval is when a loan officer reviews your debt, income, credit, and assets and determines if you’re eligible for a mortgage loan and how much money you should receive.

How Long Does a Mortgage Pre-Approval Last?

Once you have received that coveted mortgage pre-approval letter, you may be wondering how long it’s good for. All pre-approval letters will have an expiration date on them. After that date, it will no longer be valid.

Most lenders will put an expiration date on a mortgage pre-approval letter because they need your most up-to-date financial data, including your credit score and income. For instance, you may get laid off from your job and no longer have a steady source of income. This could take a big chunk out of your savings. The bank needs to know this information in order to reassess your financial situation. Your credit score may also change during this time period and you may need to apply for bad credit mortgage.

With all of that being said, a mortgage pre-approval generally lasts between 60 and 90 days. After it expires, you will need to get in touch with your lender again in order to update your information and acquire a new one.

How Can I Get a Mortgage Pre-Approval?

If you haven’t started the mortgage pre-approval process, you should so as soon as possible. In order to get pre-approved for a mortgage, you’ll need to schedule a meeting with a financial company or bank. You may also be able to complete the application online.

You should bring the following items to the meeting:

- Driver’s license

- Social security number card

- Proof of income, including pay stubs or W-2 forms

- Credit information

- Tax documents

Your lender will review all of these documents and could pre-approve you as soon as that same day.

Should You Apply for Mortgage Pre-Approval?

If you are in the process of buying a new home, you should apply for a mortgage pre-approval. It will save you a lot of money in the long run.

The Bottom Line

When you think, how long does a mortgage pre-approval last, the answer is 60 to 90 days. It’s important to know this in order to not allow your pre-approval letter to expire. Other things to consider when applying for a mortgage pre-approval is your mortgage pre-approval checklist of items you need to bring to the meeting with the bank.

If you want to learn more about important financial topics, be sure to read other financial articles on our website!